Spotlight Series: Dr. Bill

The physician billing process in Canada sucks. Dr. Bill looks to change that

The second company profiled in Spotlight Series is Dr Bill, a billing platform looking streamline the currently outdated Canadian physician billing process. By providing doctors with a user-friendly mobile first platform along with expert billing support, Dr Bill looks to deliver industry-leading billing success rates for its clients.

Dr. Bill was founded by the husband of a physician, who after watching his wife spend hours a week filling out billing paperwork just so she could get paid for her work thought, ‘there has to be an easier way1” This resulted in the idea and development of an easy to use mobile billing platform, where physicians could bill directly from their phone, and do so in a manner that simplified the entire billing process.

Dr Bill currently operates in Ontario, Alberta and British Columbia.

Acquired by RBC Ventures

Dr Bill was acquired by RBC Ventures2 in February of 2019, with RBC looking to beef up its tech portfolio. Having Dr Bill’s roster of physicians to also potentially draw from and pull into other aspects of their business, such as becoming RBC Healthcare clients is not a bad perk either, which I’m (kinda) sure played a part in the bank’s decision to buy the company.

Background

How Physicians Get Paid

In 2017-2018, the Ontario government paid out over $12.6 billion to physicians, with the majority of it ($7.3B) generated through fee-for-service payments.

Other common forms of payment include Capitated Billing (I.E: A flat fee for taking care of a patient for a time-period) and Fixed Salaries3.

The Problem

The physician billing process across the various Canadian provincial health systems can at times be inefficient and unintuitive, with a fair amount of doctors and clinics still reliant on paper-based solutions. This has resulted in many individuals spending hours a week managing their billing process, whether it be preparing new invoice documents to send for reimbursement, or managing billing rejections/errors. No one wants to deal with annoying clerical tasks, especially when you’re already working >40 hours a week. Add to the fact that when a doctor’s billing invoice is rejected they are not paid for the specific service they provided and you have a what can be very frustrating issue.

Dr. Bill’s Solution: Medical Billing Made Easy

A user-friendly mobile first platform that simplifies the physician billing process by allowing physicians the ability to complete the entirety of their billing duties on their phone. Less time spent billing and a higher payout success rate means that doctors can treat more patients, increase their revenue, AND work less.

Dr. Bill’s Goals

Save time and boost overall productivity

Reduce billing rejections

Increase revenue for its users

Provide industry leading customer support

Automate repetitive and time-consuming processes

Target Audience & Market Size

Dr Bill’s target user are Canadian Physicians who primarily utilize a Fee-for Service payment model.

While ~99% of Canadian physicians bill through a fee-for-service model at least once annually4, Dr Bill looks to focus on attracting the 70% of physicians that receive the majority of their income through this method.

As of 2020, there are 92,173 physicians in Canada, with approximately 64,521 majority Fee-for-Service physicians

Dr Bill is currently active in Ontario, Alberta and British Columbia, which is home to 58,100 total physicians, 40,670 being primarily fee-for-service.

Total Target Audience: The 40,670 fee-for service physicians in Ontario, B.C and Alberta

I don’t foresee Dr. Bill expanding anytime soon to the other provinces considering how much smaller (besides Quebec) those markets are. With <3,000 physicians currently in its roster, Dr. Bill will need to focus on increasing market share in the markets that it currently operates in.

Market Growth

Using historical growth rates, I projected the Fee-for-Service physician supply from 2021-2023 for Ontario, Alberta and B.C

Notes/Assumptions

The High Growth case numbers were based off the average yearly physician supply change between 2016-2020, where there was significant physician growth

The Low Growth case numbers were based off the percentage change from 2019-2020, where growth was stagnant or even negative in the case of some provinces

The Mid Growth case numbers were the average % change of the high and low growth cases

Projected Market Size

Observations

Dr. Bill is operating in a mature market where physician supply levels are relatively stable.

Even in the high growth scenario, physician supply in the 3 provinces is expected to only increase by 2.1%-3.16% per year in the near future

British Columbia has by far the highest levels of estimated physician growth across all scenarios

Total Market Size for Dr. Bill by 2023 is projected to be between 40.8K-43.7K physicians

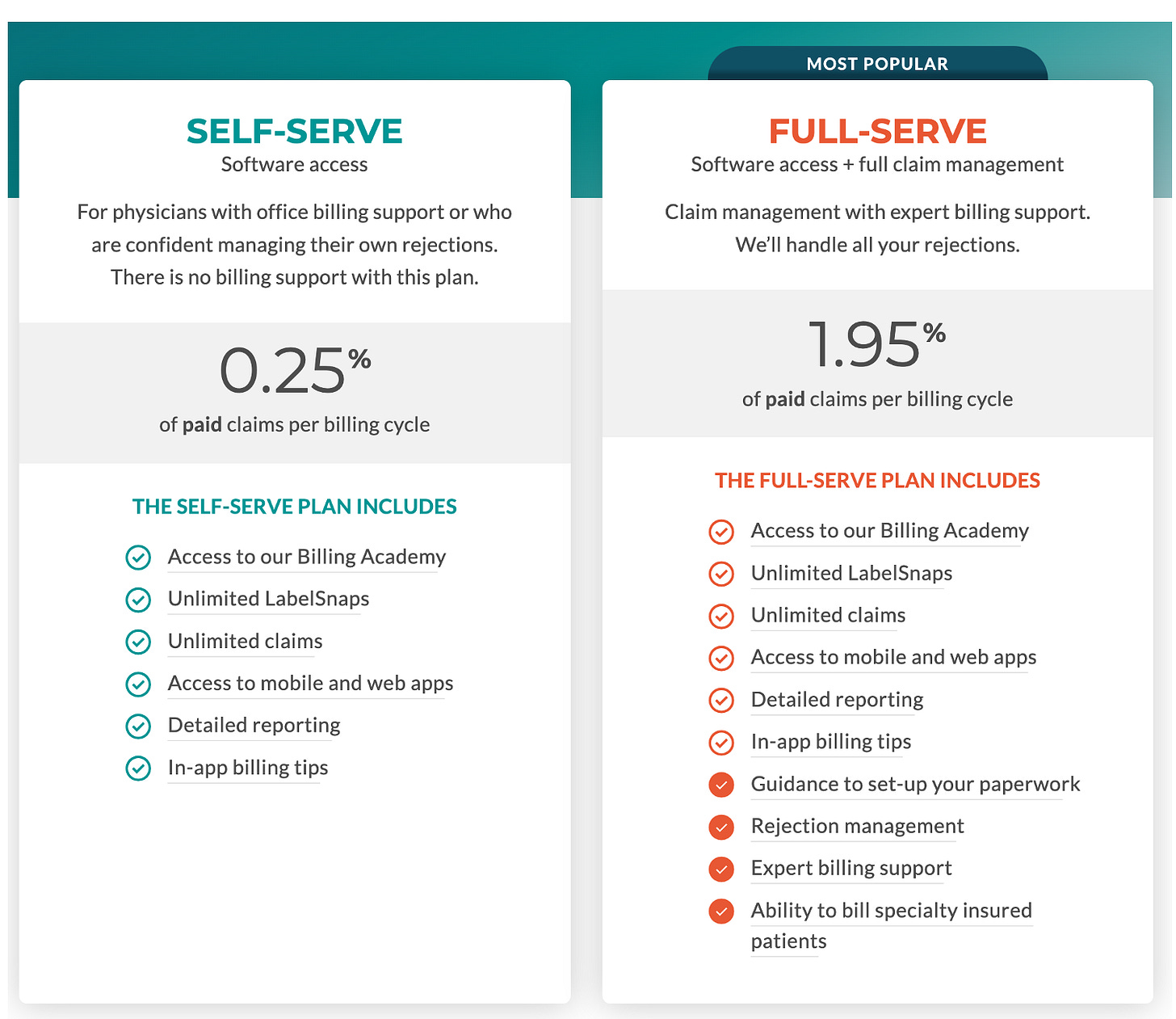

Dr. Bill’s Business Model (How Do They Make Money?)

Dr. Bill takes a percentage of paid claims per billing cycle

Either 0.25% or 1.95%, dependent on what plan the physician is subscribed to.

1) Self-Service (0.25%): Allows for access to Dr. Bill’s software

2) Full-Serve (1.95%): Along with access to Dr. Bill’s software, users are able to utilize the company’s plethora of claims management and support features. This includes:

Paper-work Set-up Guidance

Billing Rejection Support

Live Expert Billing Support

Ability to Bill Specialty Insured Patients

How Much Revenue does Dr. Bill Currently Generate?

I decided to dive in and estimate Dr. Bill’s annual revenue using available information

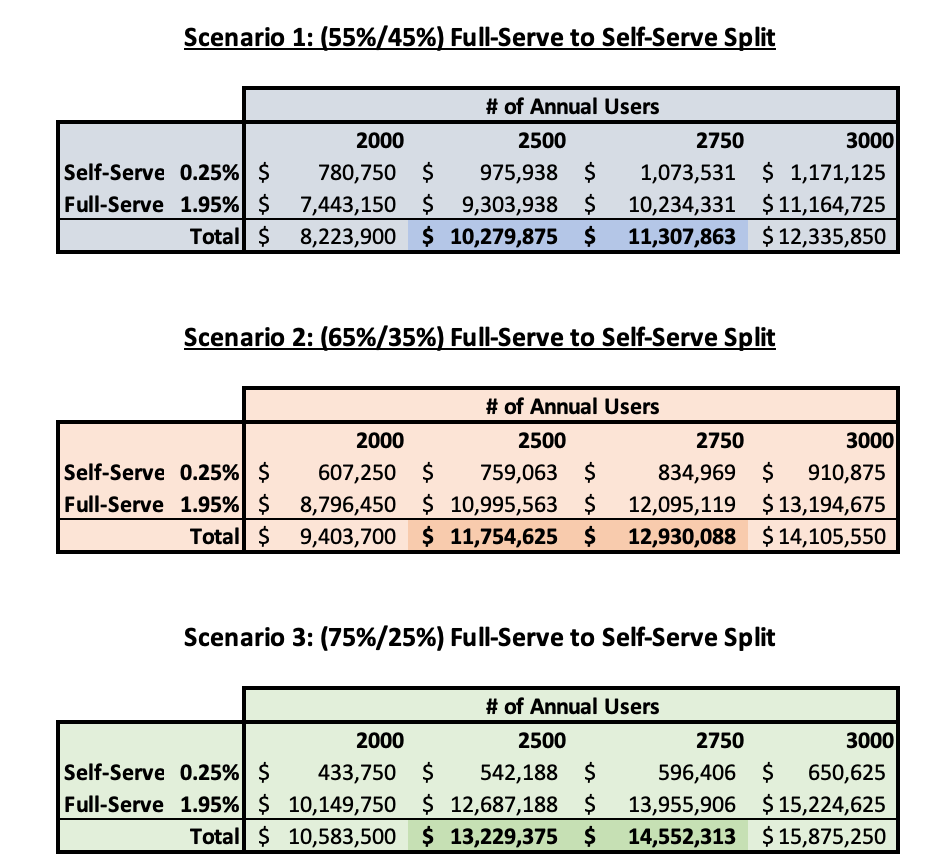

Table Notes/Assumptions

Average User Billing- I used the Average Physician Gross Clinical Payment value taken from CIHI’s 2019 Physicians in Canada Report, which is $347,000

Number of Current Users: Since inception, Dr. Bill has worked with around 3,000 physicians, so I created revenue scenarios that incorporated a range of current user estimates (2,000-3,000 users)

Full Serve/Self Serve Split: Dr Bill mentions that its Full-Serve Option is its most popular, so I created scenarios showing a 55%/45%, 65%/35% and 75%/25% split between the two plans.

Scenarios: Dr. Bill’s Annual Projected Revenue

Highlights/Observations

Looking at all 3 scenarios, it’s projected that Dr Bill generates anywhere between $8.22MM-$15.88MM annually, with the number likely closer to the $10.30MM-$14.52MM range.

The vast majority of revenue comes from Full-Serve clients, who pay ~8x the billing rate than those on the Self-Serve plan. With such a discrepancy in plan rates (1.95% vs 0.25%), I would assume that Dr. Bill is really pushing for physicians to subscribe or upgrade to their Full-Serve plan.

A Dr. Bill Full-Serve user that bills the average Physician Gross Clinical Annual Payment amount of $347,000 would be charged $6,767 per year

A Self-Serve user billing the same amount would be charged $868 per year

Competition

It only took a quick google search to inform me that there’s a TON of competition in the Canadian physician billing sector, which is unsurprising considering the lack of an adequate product by the provincial governments. The competitors in the space provide a varying level of services, from basic self-serve software all the way to premium options where physicians and clinics are assigned their own dedicated billing agent.

Dr. Bill’s main competitor looks to be MDBilling, who like Dr. Bill also provide very similar self-serve and full-service plans on a mobile first platform. The company is currently active in both Ontario and B.C, with over 8,700 physicians on their roster and $2.3B billed since their inception in 2008. Additionally, their rates are almost identical, consisting of a 0.25% fee for self-serve and 2% for full service.

MDBilling knows that Dr.Bill is a competitor, so much so that when you type “Dr Bill” on Google you get an ad with the title ‘Don’t Use That – We’re Way Better” Besides being hilarious, I could see this ad actually working pretty effectively.

As long as physicians are being paid through a fee-for-service model, medical billing is going to be required, so why not make it as painless as possible. Physician burnout is one of the most significant challenges facing our health system, with over 1 in 4 physicians reporting high levels of burnout5. The reasons for the high rate of burnout is multi-factorial, with clerical burden being associated by many as the number one contributing factor6. This is where services like Dr. Bill come into play. Physicians should be concentrating on performing physician related services, and if Dr. Bill can swoop in, save their users a few hours of (what must be very mind-numbing) clerical work a week, burnout levels may be reduced.

The well-being of healthcare professionals can affect the overall quality of care given to patients, and if Dr Bill and its competitors can contribute to that while generating profits, all parties involved are left better off!

https://www.dr-bill.ca/about

https://www.health.gov.on.ca/en/pro/programs/pcpm/#:~:text=Family%20Health%20Network%20(%20FHN%20)%20and,premiums%20based%20on%20patient%20enrolment.

https://www.dr-bill.ca/ohip-billing-guide/medical-billing

https://www.cma.ca/physician-wellness-hub/topics/burnout

https://www.dr-bill.ca/blog/updates-news/the-main-reason-why-physicians-get-burned-out/